Why PeakAlpha

Our aim is to provide every woman client the confidence to be financially independent

We work with more than 1400 women, which is nearly 36% of our total customer base.

We’re on our way to the 50% mark.

Our services are particularly invaluable to those women who are financially vulnerable, such as those going through a separation, divorce or the death of a breadwinner. In divorce cases, we help decide on a fair settlement, often working in tandem with their lawyers to get what is rightfully due to them.

Women get the short end of the stick when it comes to money

- Earning less and taking career breaks directly impacts a woman’s financial independence

- When they do come back into the workforce, they are paid less than their previous salaries

- Women outlive men and spend more on healthcare

- Growing instances of divorce entails that women need to take control of their financial future now

Did you know that for every Rs. 100 a man earns, a woman earns Rs. 20 less, for the same job?

What you earn determines what you save and invest.

If you earn less, you will invest less and this has a very tangible effect on how you create wealth and meet your goals.

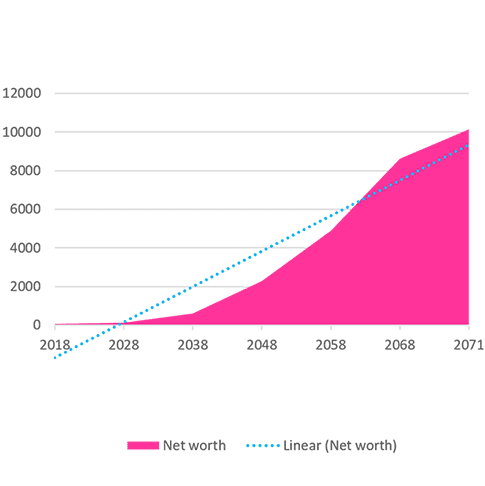

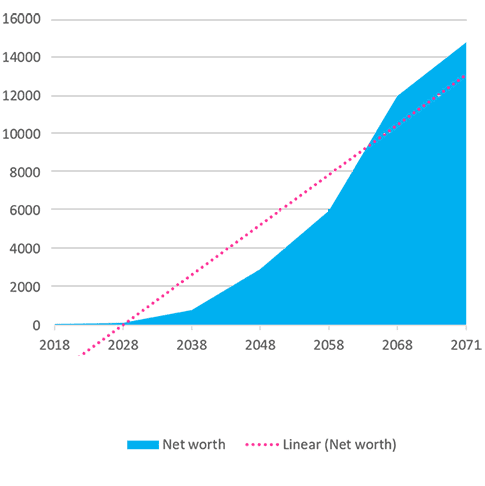

Take a glance at the chart and you’ll understand how the gender pay gap affects wealth creation.

AN EMPLOYED WOMAN

Earns annual income X. Income grows at 7%. Saves 20% of income. Accumulates Y crores at age 80

AN EMPLOYED MAN

Earns 1.25X of woman’s annual income. Income grows at 8%. Saves 30% of income. Accumulates 1.5Y crores at age 80, 50% higher than a woman’s!

* Assumptions: Both woman and man are 25 years old, work till 58, and have the same set of expenses.

* According to the Monster Salary Index on gender for 2016, the gender pay gap ranged from a relatively low 14.7% in the education and research sector to 21.5% in the banking, financial services and insurance sector and 25.8% in the information technology sector.

- She has natural instincts and inborn traits, ideal for financial planning

- She is cautious and makes lesser mistakes, ensuring stability and security in the family’s investment portfolio

- She is risk averse and hence shies away from speculative transactions such as stock trading. She is more likely to invest in long-term instruments with steady and predictable returns

- Her innate nurturing temperament ensures that money is always put away for contingencies, so unforeseen circumstances don’t rock her family’s boat too much

A woman can change the financial fortunes of a family

Be the master chef of your financial kitchen!

- Recipes for Successful Financial Planning is a workshop explaining financial concepts with food analogies. It’s an unforgettable, mouth-watering experience!

- The workshop has an extremely visual slide pack, and a racy narrative peppered with case studies and anecdotes

- Our talks are non threatening and remove the cobwebs in your mind about the difficulties of managing money

- We explain financial concepts in a way your grandmothers would understand!

Want us to conduct the Recipes for Successful Financial Planning at your organization? Call us at +91 80 46720700 or write to us, and we’d be delighted to speak to you!